The Best Guide To Insurance Asia Awards

Wiki Article

The Ultimate Guide To Insurance Advisor

Table of ContentsThe 9-Minute Rule for Insurance And InvestmentThe Buzz on Insurance AgentSome Ideas on Insurance Asia Awards You Should KnowUnknown Facts About Insurance CommissionThe Greatest Guide To Insurance Agent

The finest life insurance coverage policy for you comes down to your requirements as well as spending plan. With term life

insurance insurance coverage as well as entire insurance, premiums typically are fixedTaken care of which means suggests'll pay the same exact same quantity month. Health and wellness insurance coverage and also car insurance are called for, while life insurance coverage, homeowners, tenants, and special needs insurance coverage are urged.The Best Strategy To Use For Insurance Ads

Below, we've clarified briefly which insurance policy coverage you ought to highly take into consideration buying at every stage of life. When you leave the functioning world around age 65, which is commonly the end of the lengthiest plan you can buy. The longer you wait to purchase a plan, the better the eventual expense.If a person else counts on your revenue for their financial well-being, after that you probably need life insurance coverage. The best life insurance coverage plan for you depends on your spending plan as well as your economic goals. Insurance coverage you need in your 30s , Home owners insurance, House owners insurance is not called for by state legislation.

What Does Insurance Do?

-If, however, you make it through the term, no cash will be paid to you or your family members. -Your family obtains a certain sum of cash after your fatality.-They will likewise be qualified to a bonus offer that typically builds up on such quantity. Endowment Policy -Like a term plan, it is additionally valid for a specific duration.- A lump-sum quantity will be paid to your family in case of your fatality. Money-back Policy- A certain portion of the amount ensured will be paid to you periodically throughout the term as survival benefit.-After the expiry of the term, you obtain the equilibrium amount as maturity earnings. -Your household obtains the whole amount assured in situation of death throughout the plan duration. The quantity you pay as costs can be deducted from your total taxable income. Nevertheless, this undergoes a maximum of Rs 1. 5 lakh, under Area 80C of the Revenue Tax Obligation Act. The premium amount used for tax reduction need to not surpass 10 %of the amount guaranteed.What is General Insurance? A basic insurance is an agreement that offers monetary compensation on any type of loss other than death.

The 10-Minute Rule for Insurance Agent

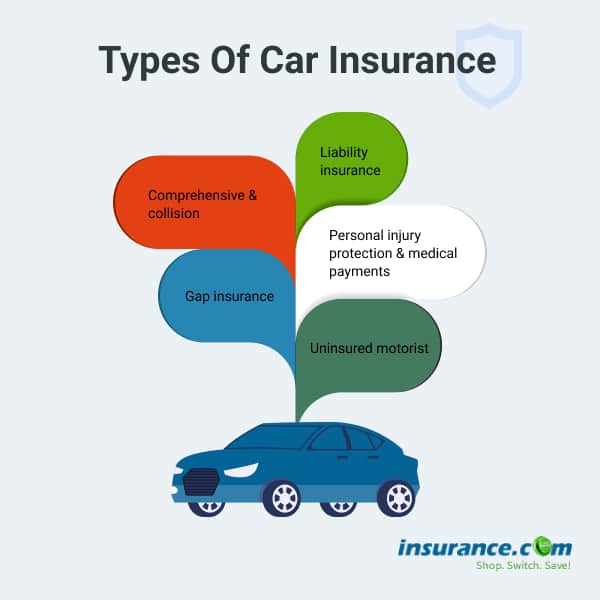

The insurer settled the costs straight at the garage. insurance bond Your medical why not find out more insurance took treatment of your treatment costs. Your financial savings, hence, stayed unaffected by your sudden illness. As you can see, General Insurance policy can be the response to life's numerous issues. For that, you require to select the right insurance policies from the myriad ones offered. What are the types of General Insurance readily available?/ What all can be guaranteed? You can get practically anything and whatever insured. Pre-existing conditions cover: Your medical insurance takes care of the therapy of illness you might have prior to buying the wellness insurance plan. Mishap cover: Your medical insurance can pay for the clinical treatment of injuries created because of accidents and also accidents. Your wellness insurance coverage can additionally help you conserve tax.Two-wheeler Insurance coverage, This is your bike's guardian angel. It's comparable to Vehicle insurance policy. You can not ride a bike or mobility scooter in India without insurance. Just like auto insurance, what the insurance company will certainly pay depends on the kind of insurance coverage and also what it covers. 3rd Party Insurance Comprehensive Automobile Insurance Policy, Compensates for the damages triggered to an additional person, their lorry or a third-party residential property.-Damages created as a result of man-made activities such as riots, strikes, etc. Home structure insurance This safeguards the insurance group structure of your home from any kinds of risks and damages. The cover is also included the permanent fixtures within the house such as kitchen and restroom fittings. Public liability coverage The damages created to an additional individual or their residential property inside the insured house can likewise be compensated.

Report this wiki page